Stablecoins: The $30 trillion market building tomorrow’s financial rails

Stablecoins are moving more money than Visa and Mastercard, but still make up just 1 percent of the global monetary supply. Here’s what needs to change.

By Joey Prebys•July 11, 2025

By Joey Prebys•July 11, 2025

What you can expect

- A real-world look at how stablecoins are used in Latin America

- Why large enterprises are embracing stablecoin infrastructure

- The regulatory, UX, and liquidity bottlenecks still holding the space back

- How Web3 payment infrastructure is evolving behind the scenes

- What’s coming next from Bastion, Zero Hash, and Ripio

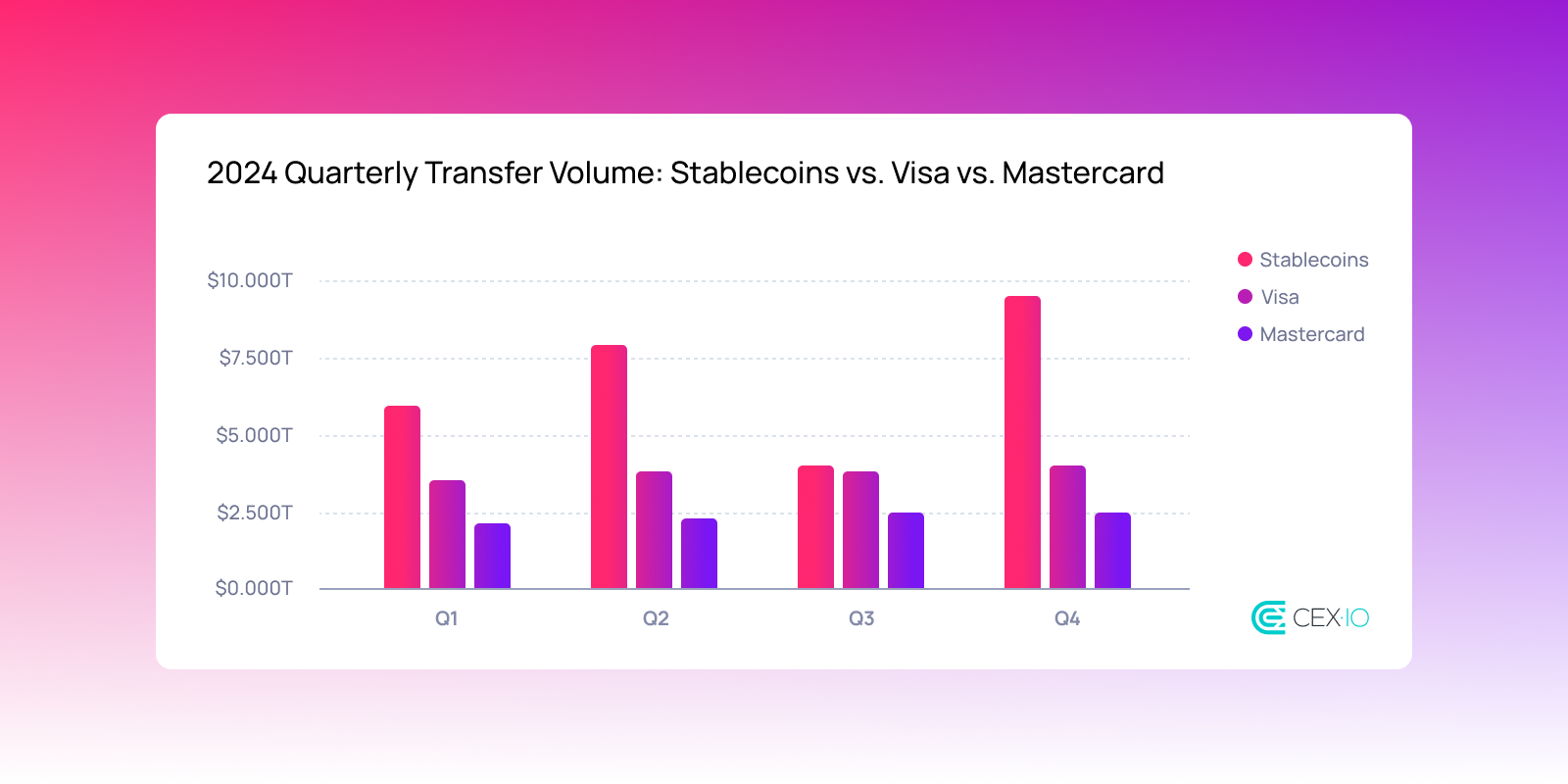

Stablecoins have quietly become one of crypto’s most adopted products. Originally designed as a convenience for traders, they’ve since evolved into a foundational layer for payments, remittances, savings, and institutional finance. With an annual transfer volume of around $30 trillion, they now surpass Mastercard and Visa combined. But while the numbers are impressive, the more important question is: what's next?

To explore this, The Decentralized Mic brought together a panel of leaders representing the full spectrum of stablecoin adoption. The conversation was moderated by Nicolas Arevalo, co-founder of Velocity Labs, a development hub focused on building DeFi infrastructure in the Polkadot ecosystem.

Featured guests included:

- Bastion, a compliance-first infrastructure provider that helps global enterprises issue, manage, and integrate stablecoins into their financial operations.

- Zero Hash, a turnkey backend-as-a-service platform enabling fintechs and consumer apps to offer stablecoin wallets, trading, and transfers without handling custody or regulatory risk.

- Ripio, one of Latin America’s largest crypto platforms, providing millions of users with access to stablecoin wallets, savings products, and cross-border payments.

From merchant payments in Argentina to backend rails for global companies, the panel covered how stablecoins are used today—and what’s still holding them back.

Why stablecoins are gaining momentum globally

While stablecoins started as a tool for traders, their most important use cases today are far more practical: payments, savings, and international commerce.

For users in Argentina, the reasons are immediate and deeply personal. As Ripio Product Owner Nicolás Tezari shared, “We had like 50% inflation a year... with months like 30% inflation in a month.” Stablecoins offer an escape from volatile local currencies, giving people a way to store value, pay merchants, and even access financial services without relying on the formal banking system. “We're trying to help people,” he said. “They want to just use the technology because they need to access it.”

Nassim Eddequiouaq, Co-Founder and CEO of Bastion, added that stablecoins are also solving major pain points for global companies. “They’re inherently more valuable,” he said. “More spendable, more programmable, and more usable, and it's just safer.” From faster cross-border payments to real-time treasury operations, stablecoins let businesses move money globally without sacrificing yield or taking on excessive overhead.

Mark Daly, Chief Business Officer of Zero Hash, emphasized just how many new platforms are jumping in: “The velocity of new players entering this space is incredible. Groups that you wouldn’t have thought would be here a year ago are now going live with stablecoin products.”

What's enabling the growth

So why is all this happening now?

For one, the infrastructure has improved. Developers no longer need to build from scratch or manage every layer of custody, compliance, and asset transfer. Companies like Bastion and Zero Hash are offering stablecoin-as-a-service platforms, abstracting away complexity and allowing businesses to launch quickly.

At the same time, regulatory progress is creating more confidence. Frameworks like MiCA in Europe and the proposed US-based Genus Act are giving large institutions the clarity they’ve been waiting for. “The incentives are there,” Nass said. “Constituents care about digital assets. And the deeper-pocketed interests want access too.”

Consumer adoption has also reached new heights. Mark pointed to the “hundreds of millions” of users now plugged into stablecoin-powered systems through platforms like PayPal, Revolut, and Ripio. “There’s just easy access for the end customer,” he said.

What’s still holding stablecoins back?

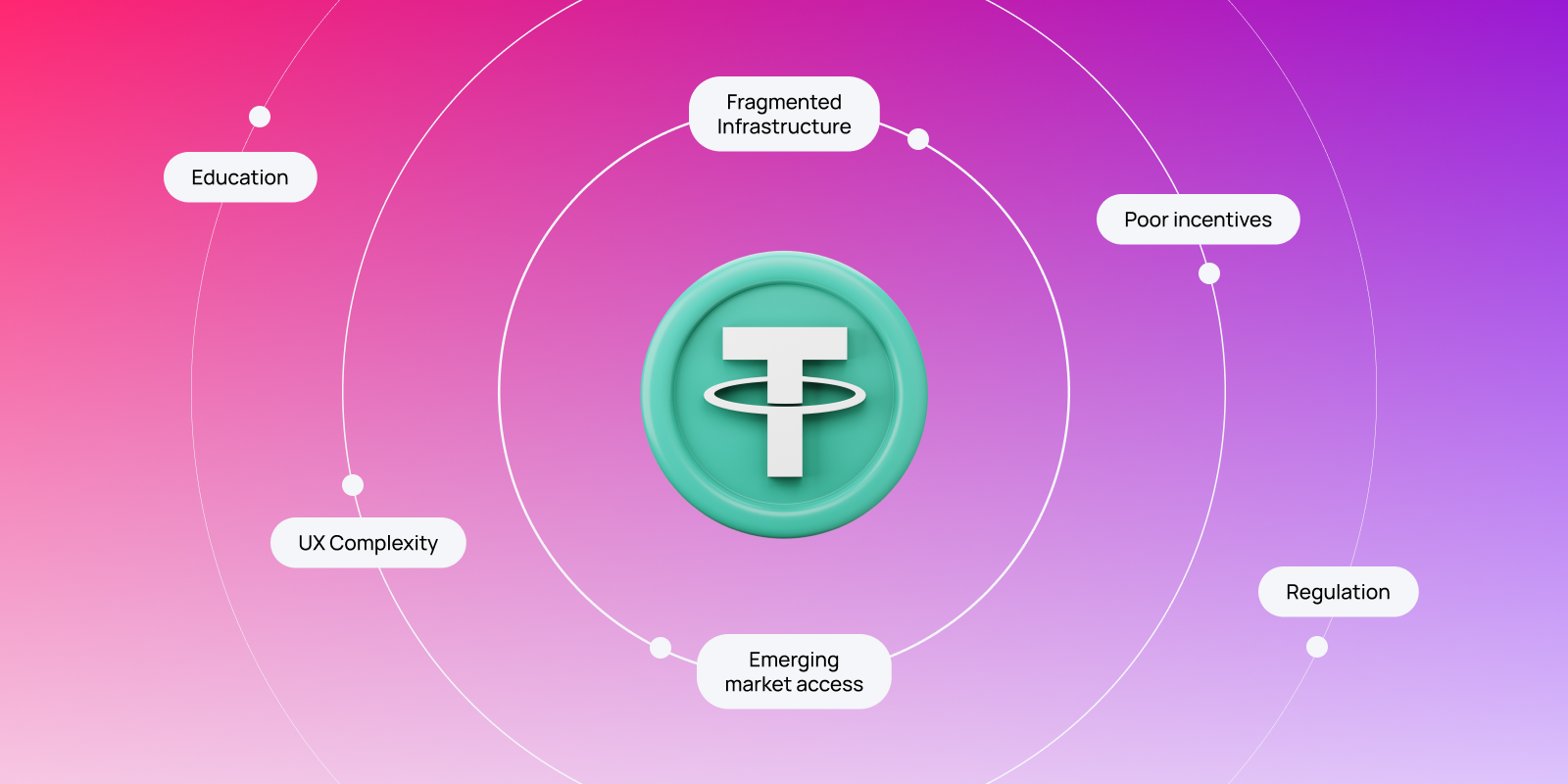

Despite their rapid rise, stablecoins still represent just 1% of the global monetary supply. To reach 5–10%, major bottlenecks must be addressed, especially around regulation, UX, and infrastructure fragmentation.

Nass laid out three clear challenges:

- Regulatory uncertainty, which makes risk-averse enterprises hesitant to commit.

- UX complexity that still requires users to think about chains, bridges, or gas fees—a barrier for mainstream adoption.

- Poor incentive structures that don’t yet reward merchants, platforms, or users for adopting stablecoins at scale.

Mark echoed the importance of UX, noting, “It’s not going to reach 10% if I have to ask what chain you’re on just to send you USDC.” Instead, he argued, the future must feel more like a seamless account-to-account experience, no different than using a neobank app today.

For Nico, especially in Latin America, the challenges also include infrastructure gaps and education. “We don’t always have reliable on-ramps or access to the latest mobile devices,” he said. “We need to make it as smooth and invisible as possible.”

The shift from chain-native to chain-agnostic

Another sign of the sector’s maturity is the move from chain-aligned stablecoins (like DAI on Ethereum) to chain-agnostic deployments (like USDC across multiple chains, including Polkadot). Nass explained that issuers today are optimizing not just for chain availability, but for distribution and liquidity: two key indicators of success.

Issuers need the ability to:

- Move easily between chains

- Tap into the most liquid trading pairs (even if that means bridging into USDT or USDC)

- Route assets dynamically based on fees, yields, and local currency markets

“It looks like custody,” Nass said, “but it has a little bit of FX and smart routing built in.”

That flexibility is what makes stablecoins truly useful, both for institutions and everyday users.

What’s next for stablecoin adoption?

In the closing moments of the conversation, each speaker hinted at what’s to come:

Ripio is launching a crypto card that enables installment-based payments with stablecoins, mirroring how consumers in Argentina already use traditional credit cards. They’re also rolling out a decentralized exchange called Capify to offer users more ways to earn yield on their savings.

Zero Hash is expanding its SDKs and onboarding new enterprise clients who want to launch quickly without touching backend infrastructure. “We’re bringing best-in-class user experience from day one,” Mark said.

Bastion has several high-profile stablecoin issuances and integrations in the pipeline, including with some of the largest companies in the world. While details are still under wraps, Nass made it clear: “The rails are being built right now and we’re just getting started.”

Key takeaway: stablecoins are financial infrastructure

The stablecoin market may have started with crypto traders, but it’s quickly becoming a pillar of modern finance, powering remittances, ecommerce, payroll, savings, and treasury across both developed and emerging markets.

As Mark put it, “It becomes too big to ignore.”

To reach the next phase of adoption, the industry must continue improving user experience, building trust through regulation, and creating financial products that work across borders and devices. As this episode of The Decentralized Mic made clear, stablecoins are no longer a fringe tool—they’re becoming the default rail for programmable money.